Specifications

ACH Wallet

ACH Wallet makes your payment process easier compared to writing a check. It is secure and easier to handle and provides faster transactions than checks, saving your time and money. Online Check Writer has an ACH processing facility to help you seamlessly move money, debit, or credit. Besides, it lets you fund your ACH Wallet with a credit card, ACH transfer, wire transfer, or check.

Maximize Cash Flow

Make payments from your credit cards, even where cards are not accepted using ACH. Fund your ACH wallet and make payment directly to your payee account. ACH offers a better payment alternative for customers who do not have a credit card or prefer not to give out their credit card information.

Recurring ACH

Online Check Writer offers a recurring ACH facility to make payments to payees and the payment collection from customers. It will help businesses and individuals to pay bills on time and to avoid paying penalty fees. Moreover, We offer you free ACH transactions without any processing fees.

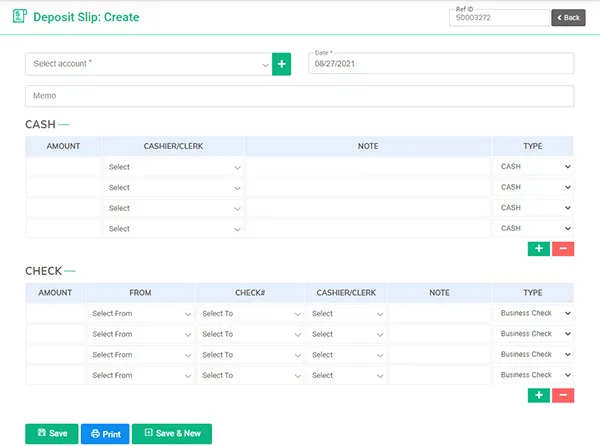

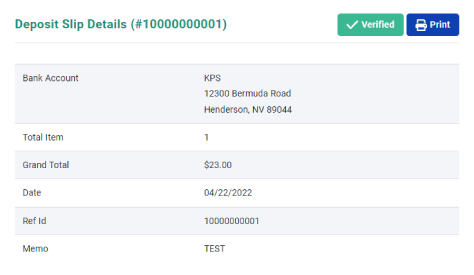

Deposit Slip

A deposit slip is a small form that a customer includes when depositing money into a bank account. In other words, a deposit slip ensures that the money is allocated into the proper account and serves as proof of payment and as an effective receipt to keep a record of the funds deposited.

Importance of Deposit Slips

A deposit slip serves as a form of protection for both the customer and the bank. If any dispute arises with the concerned bank, the deposit slip serves as proof that the bank acknowledged receiving the funds from the customer. Thanks to Online Check Writer, you’re no longer stuck having to fill deposit slips by hand. Moreover, printing a deposit slip using Online Check Writer can be more cost-effective and time-saving than getting it from your bank or local office supply store.

Deposit Slip

Deposit slip print instantly online on-demand. Print deposit slip of bank on any standard letter size white paper using your printer. Print checks online on blank stock papers, Pay and Receive e-checks, and printable checks using our check printing software.

Cash Accounting

We want to give you the best integrated experience within the Online Check Writer – so you can keep track of all your business expenses. Moreover, documenting Cash Expenses is very convenient, and you can refer to the Expense log at any point of time in the year to generate insights and trends of your Cash Expenses.

Central Accounting

Have All Your Report in One Place : We do know that proper reporting is a core tool to improve business.

Centralized Report : Online Check Writer aggregate reports from multiple areas: Check Created, Deposit Made, Check Draft Accepted, and any Cash Expense Logged.

Categorized Report : No matter how do you enter data, all the categorized transactions are for your better understanding.

Many ways of Report : Various kinds of intelligent reports are available. By category, by Payee, by bank account, or anyhow you need.

Bank Data

Bank data can be aggregated into one place using Online Check Writer. With integrations to over 22000+ banks and financial institutions, you can connect almost 90% of banks and synchronize your bank statement with OCW. Compared to other financial management applications, intuit mint, also known as Mint.com, OCW allows you to connect with almost every USA and Canadian bank. The platform automatically operates as a bank statement generator by reconciling your checks and deposits made at banks by synchronizing both accounts. Moreover, OCW provides you bank reconciliation statement by combining both account data.

More than a Check Printing Software

Online Check Writer links all your bank accounts and financial institution into one place and reconciles your checks and deposits with your respective banks. In addition, OCW also provides you features like Pay and Get paid by ACH, eChecks, printable checks, direct deposits, and a $1 check mailing service by USPS without any transaction fees.

User Access

In OnlineCheckWriter, you can customize the access for different user roles. This way, users will only be able to access what they need to do their job in OnlineCheckWriter. You can also invite users or clients.

Set Permissions for Users

OnlineCheckWriter supports multiple users. The administrator can access any file and perform any function, but you can customize permissions for other users to limit their actions. Restricting user permissions helps limit errors and keeps your company’s information secure.

Positive Pay

Positive Pay is a mechanism that you inform your bank about your issued checks ahead of time. So your bank will not clear any checks except those you already reported. It is a widely-known cash management service used by most banks to prevent fraudulent checks. Positive Pay does so by matching the check number, account number, and dollar amount of the company’s issued check with the check presented for the payment. If the checks do not match, they will be sent back to the issuer for review.

Positive Pay with Online Check Writer

Online Check Writer now offers you an automated Positive Pay service. OCW transmits the list of issued checks of your company to the bank instantly via API, FTP, and excel sheet upload. Also, OCW will immediately inform the bank when you cancel the check and void the checks immediately. Therefore, you don’t have to notify the banks every time you issue or cancel checks manually. You can have peace of mind while Online Check Writer will take care of everything.

100% Fraud Detection

With Positive Pay, the bank provides complete fraud detection by matching the company-issued checks with those present for payment. The bank will not honor the checks if they do not correspond with the correct identifying information. It will eliminate the risk of losing money due to fraudulent activities on your account.

Exception Item

A check presented to the bank became an ‘exception item’ when it does not ‘match’ with the list of issued checks. When the bank finds an exception item, they will inform the client by sending a fax or image of the check. Then, the business will review and instruct the bank to either deny or accept the check presented. Therefore, positive pay allows companies to catch illegal checks and reduce their exposure to fraud before they have a chance to clear. Thus, companies can eliminate financial losses due to fraud and save significant money using this automated cash management service.

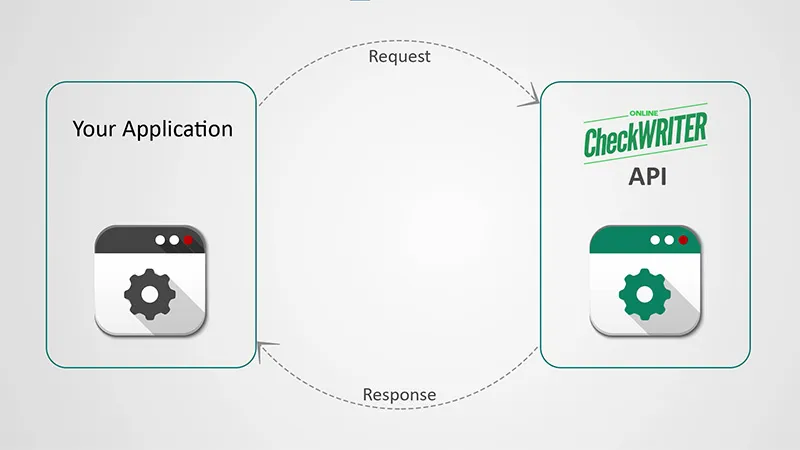

Online Check Writer API Documentation

Integrate Online Check Writer API with your application to use the phenomenal features within your own application. Online Check Writer API is free now and can be enabled easily with a simple request.